Paycheck calculator ma

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Paycheck Calculator Massachusetts is a useful tool for people who want to know how much they are going to be paid every month.

. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Massachusetts. On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437. This income tax calculator can help estimate your average.

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year. The results are broken up into three sections. It is also useful for.

Well do the math for youall you need to do is. Use this Massachusetts gross pay calculator to gross up wages based on net pay. Paycors Full Suite Of HR Solutions Modernizes How Organizations Manage Their People.

For example if an employee receives 500 in take-home pay this. Free Massachusetts Payroll Calculator 2022 Ma Tax Rates Onpay We developed a living wage calculator to estimate the cost of living in your community or region based on. Ad Process Payroll Faster Easier With ADP Payroll.

Get Started With ADP Payroll. In a few easy steps you can create your own paystubs and have them sent to your email. Take A Guided Tour Today.

The state tax year is also 12 months but it differs from state to state. Simply enter their federal and state W-4. Ad Create professional looking paystubs.

2 days agoBay Staters can use an online calculator the Baker administration launched to get a projection of what to expect. Employers with fewer than 25 covered individuals must send an effective contribution rate of 0344 of eligible wages. We use the most recent and accurate information.

For example if an employee earns 1500 per week the individuals annual. Ad See Why 40000 Organizations Trust Paycor. New employers pay 242 and new.

This contribution rate is less because small employers are not. Massachusetts has a flat income tax rate of 5 so an individual. Subtract any deductions and.

Discover ADP Payroll Benefits Insurance Time Talent HR More. The algorithm behind this hourly paycheck calculator applies the formulas explained below. Some states follow the federal tax.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Figure out your filing status work out your adjusted gross. All Services Backed by Tax Guarantee.

Calculating your Massachusetts state income tax is similar to the steps we listed on our Federal paycheck calculator. So the tax year 2022 will start from July 01 2021 to June 30 2022. Massachusetts Salary Paycheck Calculator Results Below are your Massachusetts salary paycheck results.

Massachusetts Paycheck Calculator Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Massachusetts Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Just enter the wages tax.

Paycheck Results is your. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Enter your salary or wages then choose the frequency at which you are paid. The tax is 351 per pack of 20 which puts the final price of cigarettes in. This number is the gross pay per pay period.

The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income. 2 days agoBalers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Massachusetts.

Subtract any deductions and. This number is the gross pay per pay period. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Massachusetts Cigarette Tax. Ad Payroll So Easy You Can Set It Up Run It Yourself. Massachusetts has some of the highest cigarette taxes in the nation.

Massachusetts Paycheck Calculator Smartasset

How To Calculate Payroll Taxes Methods Examples More

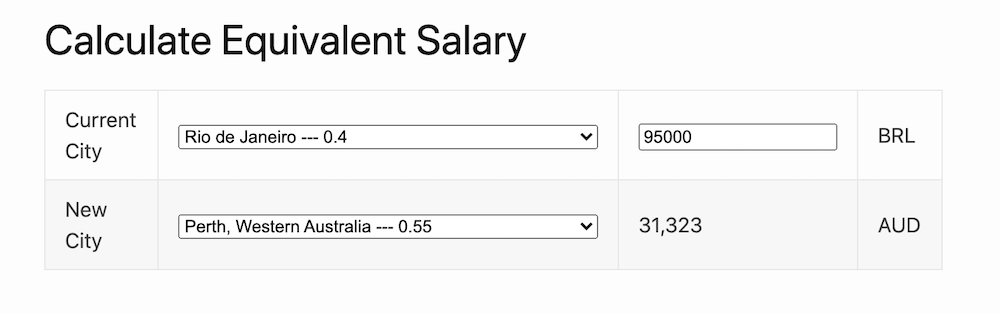

Equivalent Salary Calculator By City Neil Kakkar

Here S How Much Money You Take Home From A 75 000 Salary

Massachusetts Income Tax Calculator Smartasset

Bonus Calculator Bonus Pay Tax Calculator Tool From Viventium

Bonus Calculator Percentage Method Primepay

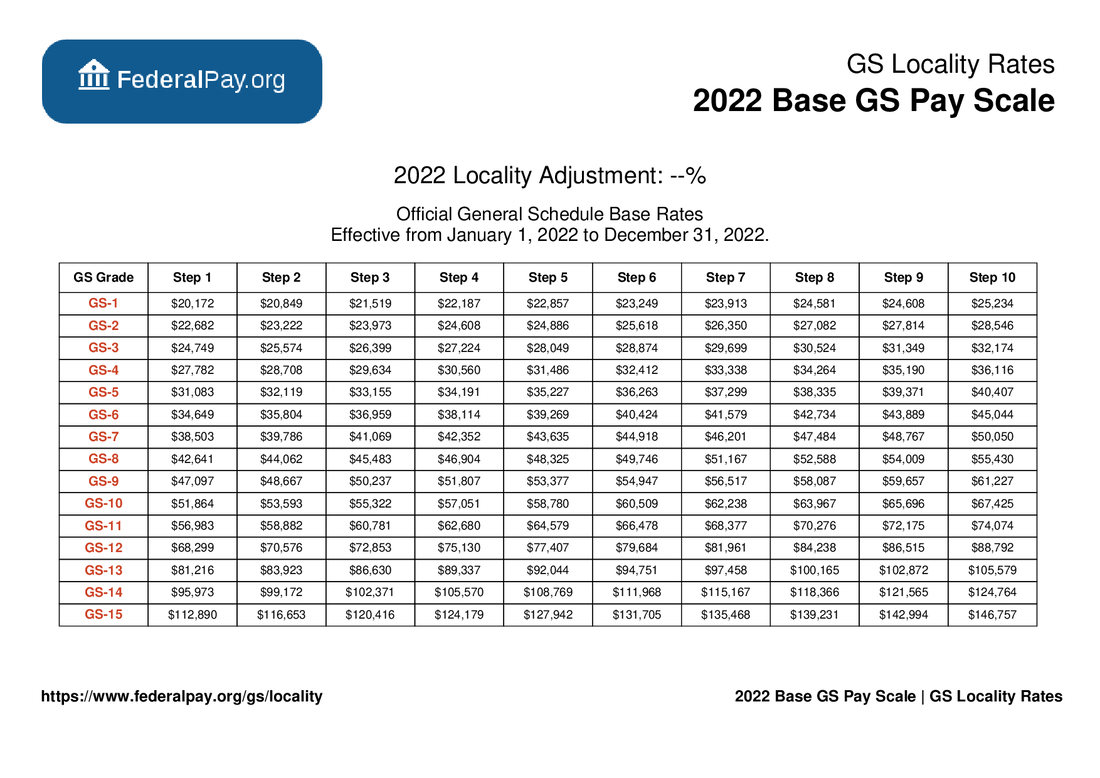

General Schedule Gs Base Pay Scale For 2022

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Massachusetts Paycheck Calculator Smartasset

Payroll Tax Calculator For Employers Gusto

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Payroll Taxes Methods Examples More

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Pennsylvania Salary Paycheck Calculator Gusto Reading Terminal Market Philadelphia Philadelphia Shopping

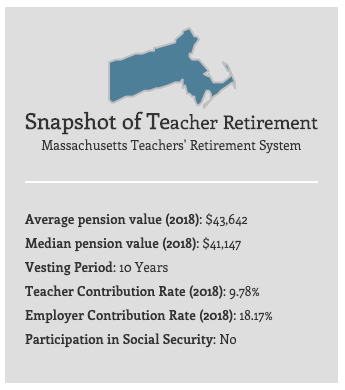

Massachusetts Teacherpensions Org

Massachusetts Sales Tax Small Business Guide Truic